Boosting user adoption for education and agriculture payment products

|

Client Partners

|

Mastercard Labs |

|

Markets

|

|

|

Methods

|

|

Mastercard’s Lab for Financial Inclusion aims to reach 100 million people with new payment solutions. Two of its flagship products are an educational platform and payment product (Kupaa) and a digital marketplace for the agricultural sector (Mastercard Farmer Network).

Both products have seen traction in their respective markets, and Mastercard is widely recognized for its efforts. To boost adoption further, the company engaged Digital Disruptions to deeply understand its users’ core needs and define what approaches it needs to take to grow its user base.

Approach & Outcome

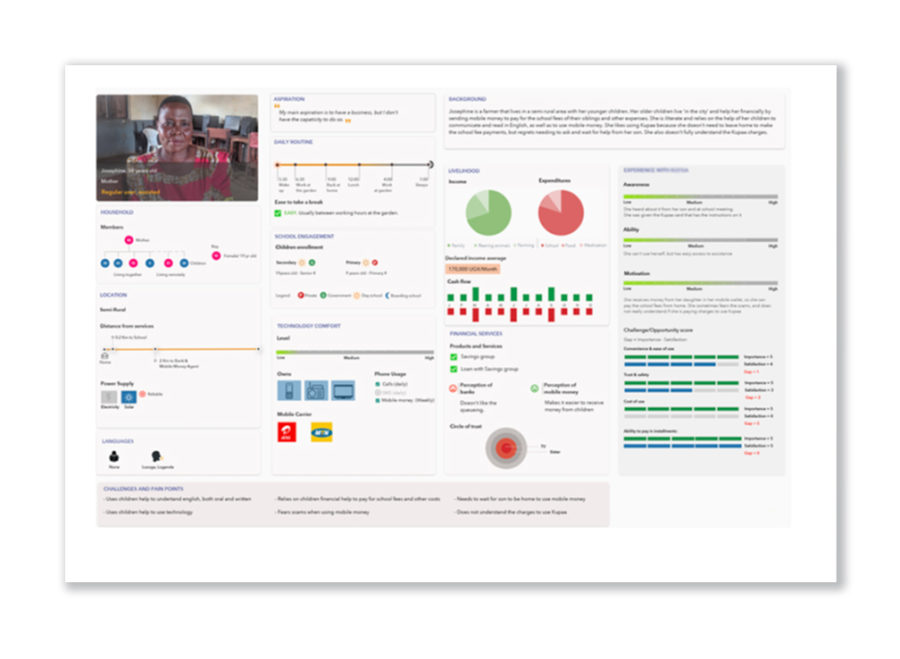

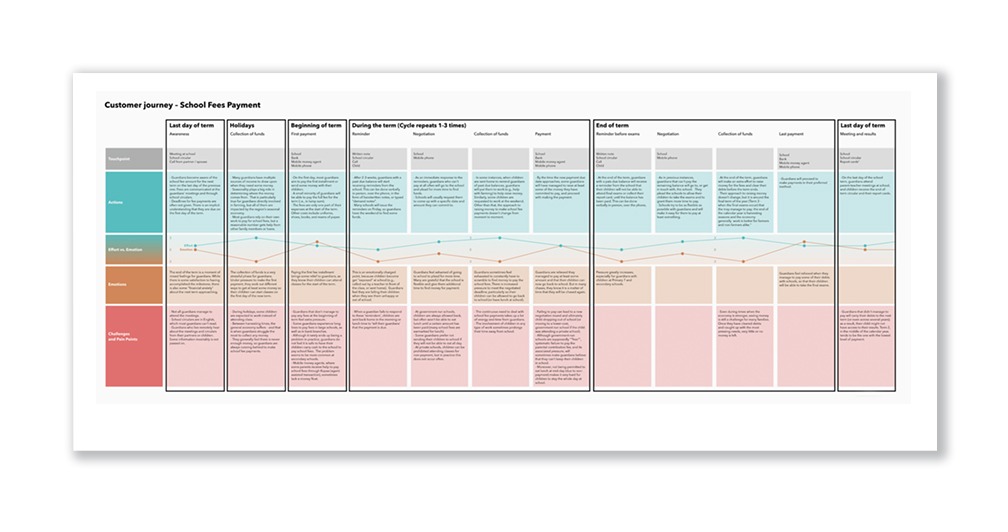

Digital Disruptions first conducted a transactional database analysis to segment users along different adoption patterns. Based on the quantitative results, we held over two dozen in-depth interviews with the identified segments for customers and merchants (in other words, schools and agribusinesses) across all three markets in urban and rural parts of East Africa and South Asia.

With the core users’ needs identified, the team facilitated an ideation session with a cross-functional team at Mastercard to brainstorm ideas for each product. Digital Disruptions then built low-fidelity prototypes to test those ideas with users. We also supplied recommendations on the framework’s key areas: value proposition, pricing and incentives, user experience, and go-to-market approach. Mastercard is currently implementing a several of these concrete recommendations as it continues to expand its product to other markets.

Working with Digital Disruptions was a breath of fresh air. Their methodology was rapid but thorough and goes beyond obvious or even easily observable take-aways to uncover strategic and business-impacting insights. The use of prototype builds the bridge to actionable outcomes and cuts time off of testing and implementing new innovations.

Salah Goss

Salah Goss

Senior Vice-President,

Mastercard

Next Case Study

Authoring a thought-leadership report on the $19 trillion merchant payment opportunity

World Economic Forum and World Bank Global

Publishing a landscape report on bringing innovations in electronic payments to small merchants in emerging markets.