Developing customer segmentation strategies to boost adoption

|

Client Partners

|

GSMA Mobile Money Program |

|

Markets

|

|

|

Methods

|

|

One of the GSMA’s fintech partners in South America had ambitious plans to reach a million customers within two years of launching a new mobile money product. Despite what appeared to be a well-thought-out product, strong partnerships, and a deep marketing budget, the product was stalling, having reached only 5% of its intended user target. The GSMA called Digital Disruptions to diagnose the problem and to propose clear recommendations to the partner.

Approach & Outcome

Within two weeks, the Digital Disruptions team integrated and synthesized several diverse data sources from the partner, such as transaction data of its various products, customer satisfaction surveys, channel costs, and product margins. We then complemented the analysis with secondary data, such as available consumer research on the target segment.

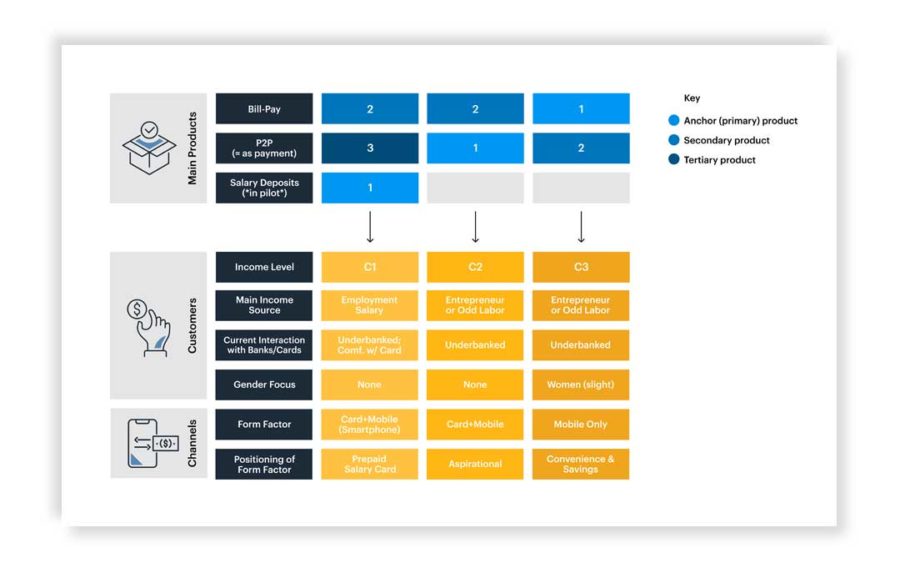

It became clear that the fintech partner was treating the low-income segment as a single, uniform market. Digital Disruptions proposed a three-vector approach to offer the right product, to the right customer, through the right channels, known as “channel-product-customer” segmentation. The results helped the organization focus its efforts on those customers segments which would most likely adopt its products and provide a sizeable source of recurring revenue.

Next Case Study

Crafting new credit products for young women

BRAC International Sierra Leone and Liberia

Using design research and product strategy to help a leading microfinance institution target an underserved market segment.