De-risking a geolocation-based feature for an Indian fintech’s new smartphone app

|

Client Partners

|

Eko and CGAP |

|

Markets

|

|

|

Methods

|

|

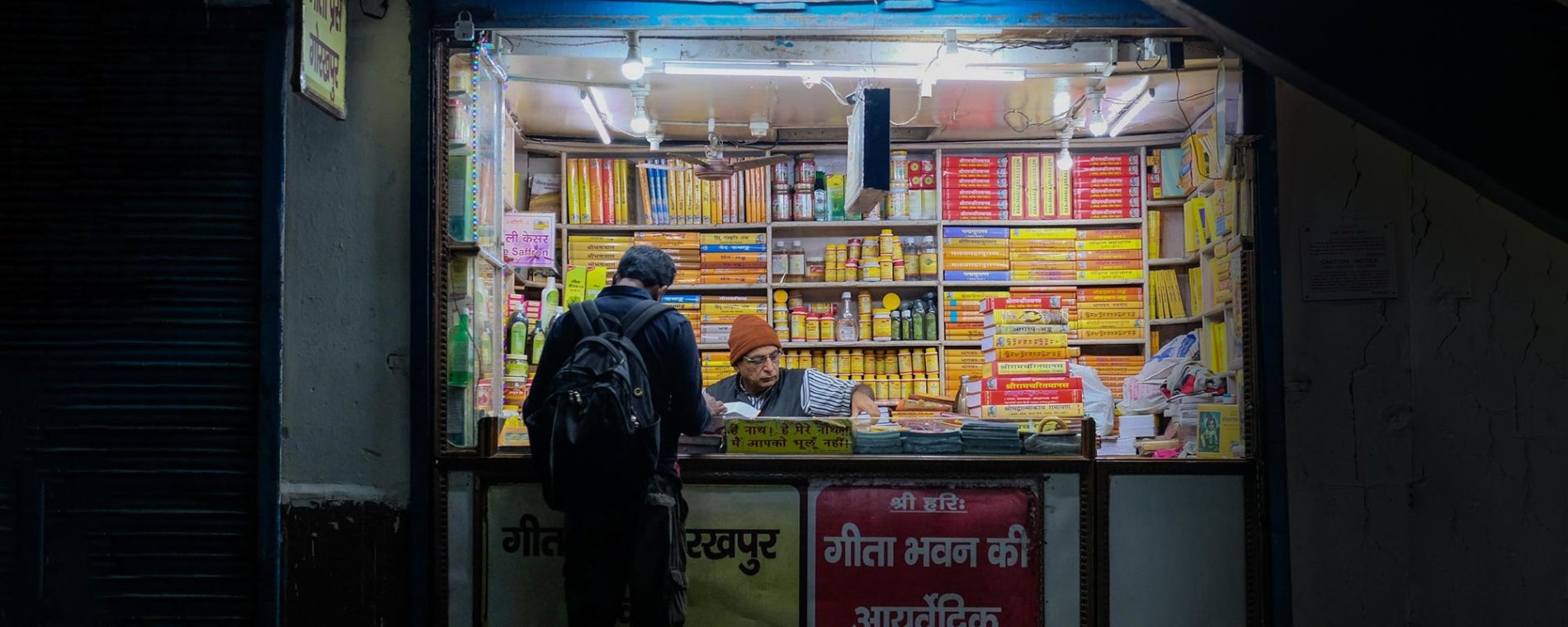

Eko is a fintech with over 13 million users in India, mainly migrant workers from poorer states in the country. These users send money home using a vast network of “cash-in / cash-out” retail agents that are part of the Eko network. The start-up wanted to assess a feature inspired by ride-sharing companies. The Eko app would match individuals who needed cash with other nearby users who could provide it within a geo-referenced area. The executives felt this would help users address cash crunches for unplanned scenarios or when agents were closed or otherwise inaccessible. CGAP, a financial inclusion think-tank housed at the World Bank, commissioned Digital Disruptions to help Eko with the assessment, particularly to find ways to reduce perceived risk and overall pricing structure.

Approach & Outcome

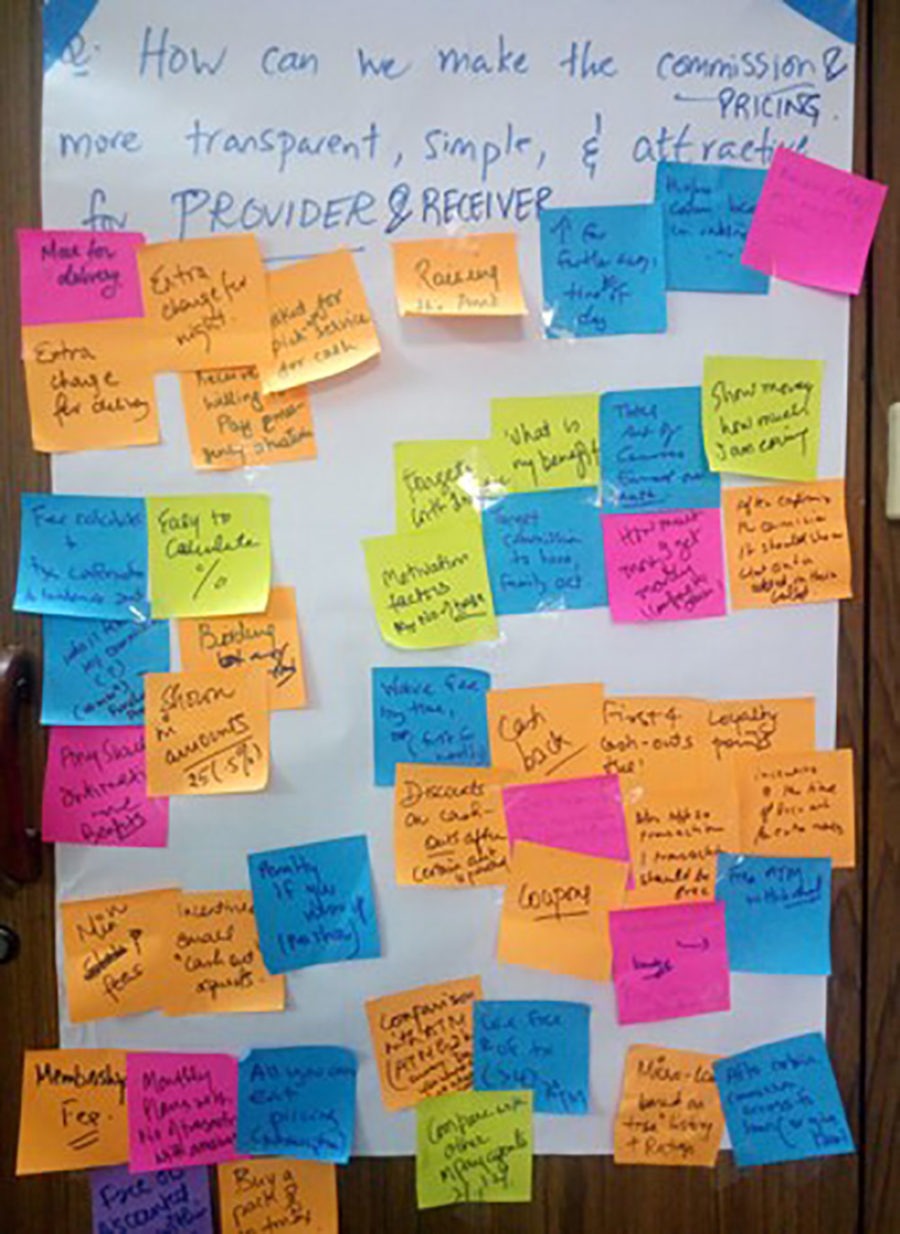

With an aggressive timeline from Eko to have concrete recommendations for a new and improved app, Digital Disruptions designed a 6-day product sprint. The sprint composed of focus groups with existing and prospective customers, usability testing, internal ideation meetings with the Eko and CGAP teams, and low-fidelity prototype building and testing sessions.

A key recommendation was for Eko to take a more prominent and visible role in “matchmaking” between the two sets of users. Through the interviews, several participants expressed reluctance to meet with strangers simply based on their nearby location. However, during the prototype testing phase, they reacted positively to the concept of Eko “suggesting” a matching counterpart while also allowing the user requesting the service to select other prospects. This recommendation, among others, helped Eko launch its first smartphone app with the feature shortly thereafter.

We partnered with Digital Disruptions to solve our biggest challenge to make cash-in/cash-out ubiquitous in India. Digital Disruptions’ expertise in product development and user testing helped Eko develop a very innovative solution to solve the problem.

Abhinav Sinha

Abhinav Sinha

Co-Founder and Chief Executive Officer,

Eko India Financial Services

Next Case Study

Creating an innovation learning agenda for FMCG supply-chain payments

Better than Cash Alliance Latin America

Developing a long-term vision to aid Fast Moving Consumer Goods (FMCG) companies in scaling digital payment efforts for small merchants.