Analyzing how users interact with mobile money to optimize merchant payment interoperability

|

Client Partners

|

International Finance Corporation |

|

Markets

|

|

|

Methods

|

|

| Download |

The International Finance Cooperation (IFC), the private sector of the World Bank, was working with a range of bank and mobile network operator (MNO) providers in Tanzania to enable mobile payment interoperability. The IFC wanted to obtain insights from customers and merchants to help inform the technical details to design interoperability, considering consumer insights, particularly around market sizing and willingness to pay. The IFC selected Digital Disruptions to conduct quantitative surveys and qualitative focus groups and then analyze the results.

Approach & Outcome

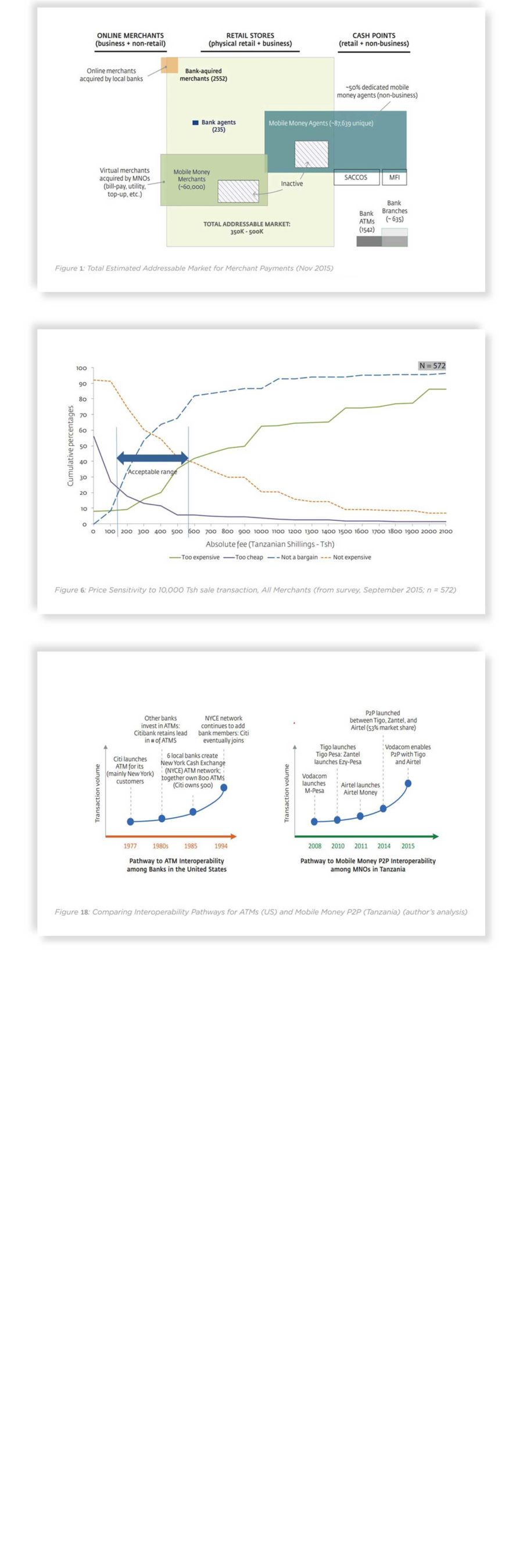

We conducted a nationwide survey of over 700 merchants and led focus groups with consumers and merchants in six major cities in Tanzania. We calculated that the market potential was roughly 350,000 to 500,000 small merchants, far more than was previously estimated. Additionally, our analysis revealed that the previous assumption by providers that small merchants were “too poor” to pay a commission to accept mobile money as a form of payment was incorrect. Using a price sensitivity analysis framework, we showed that there would be a high likelihood that merchants would be willing to pay anywhere between 1.5% and 6% of a transaction price.

The current thinking had been that enabling interoperability – in other words, allowing consumers and merchants to fully interact on multiple provider platforms – for merchant payments could spur adoption and usage of the developing product. To test this hypothesis, we decided to explore “adjacent” sectors which had successful models of interoperability, not only in financial services (ATMs in the US) but also in telecommunications (SMS in the UK) and airlines (code-share agreements worldwide). We concluded instead that it was essential that each provider first build up adoption with its own merchant payment product before interoperating with competitors. Furthermore, we suggested a middle-ground whereby providers could obtain consensus on the design of interoperability for merchant payments while running their own ‘closed’ merchant payment programs until it was mutually beneficial for the respective providers to interconnect. These nuanced insights helped guide both the IFC and the providers to develop an effective service for their respective users, as well as designing the basic blueprint to eventually interoperate.

Next Case Study

Concept testing a mobile money-based international remittances product linked to bank accounts

UNCDF, National Bank of Samoa and Digicel Samoa

Working with the country’s largest bank and mobile operator to capture bank deposits from overseas money transfers.