Producing a comprehensive landscape report on bank and non-bank agent models

|

Client Partners

|

Financial Sector Deepening Mozambique |

|

Markets

|

|

|

Methods

|

|

| Download |

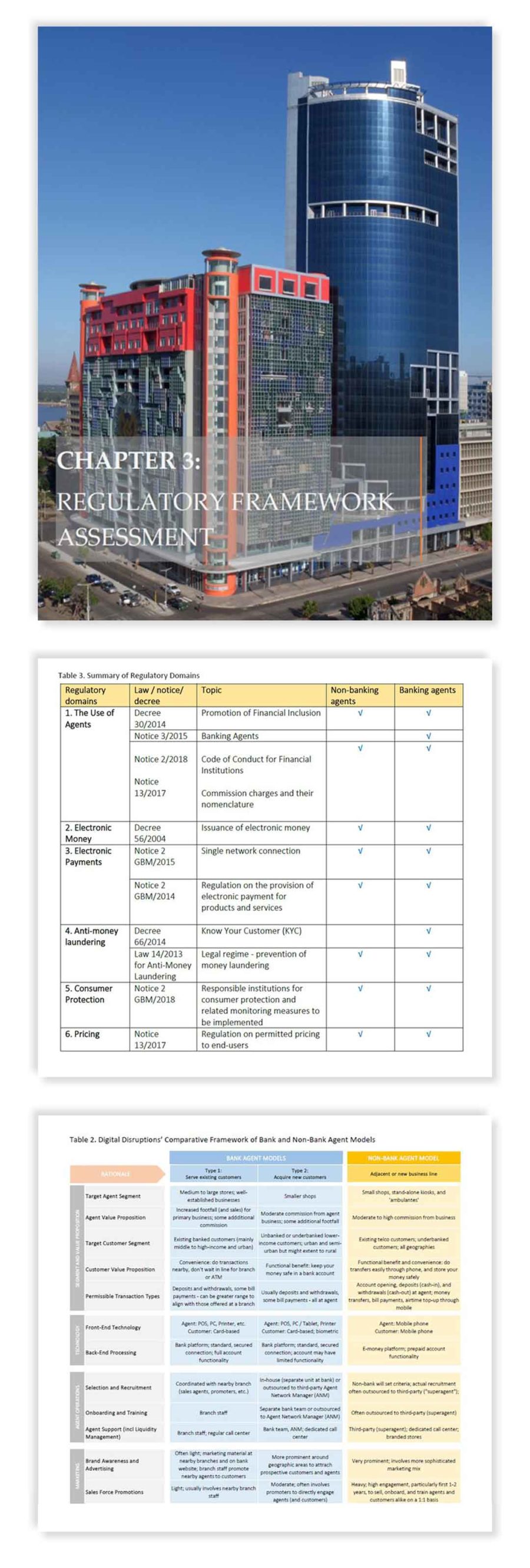

Despite progress in the past few years, Mozambique has lagged behind its neighbors in expanding financial inclusion, particularly in peri-urban and rural areas. While leveraging agents (such as small shops and pharmacies) offer promise, the Financial Sector Deepening (FSD) Mozambique team – a local market facilitator whose aim is to drive financial inclusion – felt there was a lack of public information on the topic. It hired Digital Disruptions to conduct a thorough analysis of agent models and write a public report for the industry.

Approach & Outcome

The Digital Disruptions team began by investigating the perspectives of banks, non-banks, and the country’s regulators on various agent models. In addition, we ascertained the types of findings that would be most relevant to them in a public report.

From there, we conducted detailed secondary research, including global case studies, emerging trends, and country statistics. We brought in our international frameworks on understanding different types of bank models for agents and how these contrast with non-banks such as mobile operators.

To bring in the user point-of-view, we also interviewed customers and agents in urban, peri-urban, and rural areas in two provinces of the country on their needs for basic financial services. Lastly, we conducted a deep-dive into Mozambique’s existing regulatory environment.

The result was a comprehensive report that both served both as a go-to reference document for the industry and provided strategic and tactical recommendations to service providers and the country’s central bank.

We are very pleased to have worked with Digital Disruptions, which was contracted to conduct a study to recommend an appropriate agent model for Mozambique. The recommendations they provided were clear on what needed to be adjusted according to regulation and what initiatives the Financial Service Providers (FSPs) can take themselves. The study informed changes to the agent model regulation, and based on our satisfaction with the outcome, we commissioned Digital Disruptions to develop an internal strategy to guide FSDMoç’s work on Agent Models moving forward.

Esselina Macome

Esselina Macome

Chief Executive Officer,

Financial Sector Deepening Mozambique

Next Case Study

Facilitating cross-industry workshops for payment interoperability

DAI Haiti

Using a co-creation approach to develop short-term and long-term visions for payment interoperability in Haiti.