Authoring a thought-leadership report on the $19 trillion merchant payment opportunity

|

Client Partners

|

World Economic Forum and World Bank |

|

Markets

|

|

|

Topics

|

|

| Download |

In 2016, mobile money and other electronic payments had taken off in dozens of emerging markets in Latin America, Africa, and Asia. However, the majority of these transactions were limited to exchanges between two individuals (“Person-to-Person”) and some smaller transactions such as airtime top-up and bill payments. At that time, there had only been modest efforts to bring electronic payments to micro and small retailers in these markets, most of whom relied on cash transactions.

The World Economic Forum and the World Bank hired Digital Disruptions to write a comprehensive thought-leadership report to help guide private and public sector leaders in their decision-making on the emerging topic.

Approach & Outcome

Digital Disruptions began by highlighting how merchant payments play a crucial role in driving financial inclusion. We also emphasized, particularly to the private sector, the immense size of the opportunity: $19 trillion in payment volume globally.

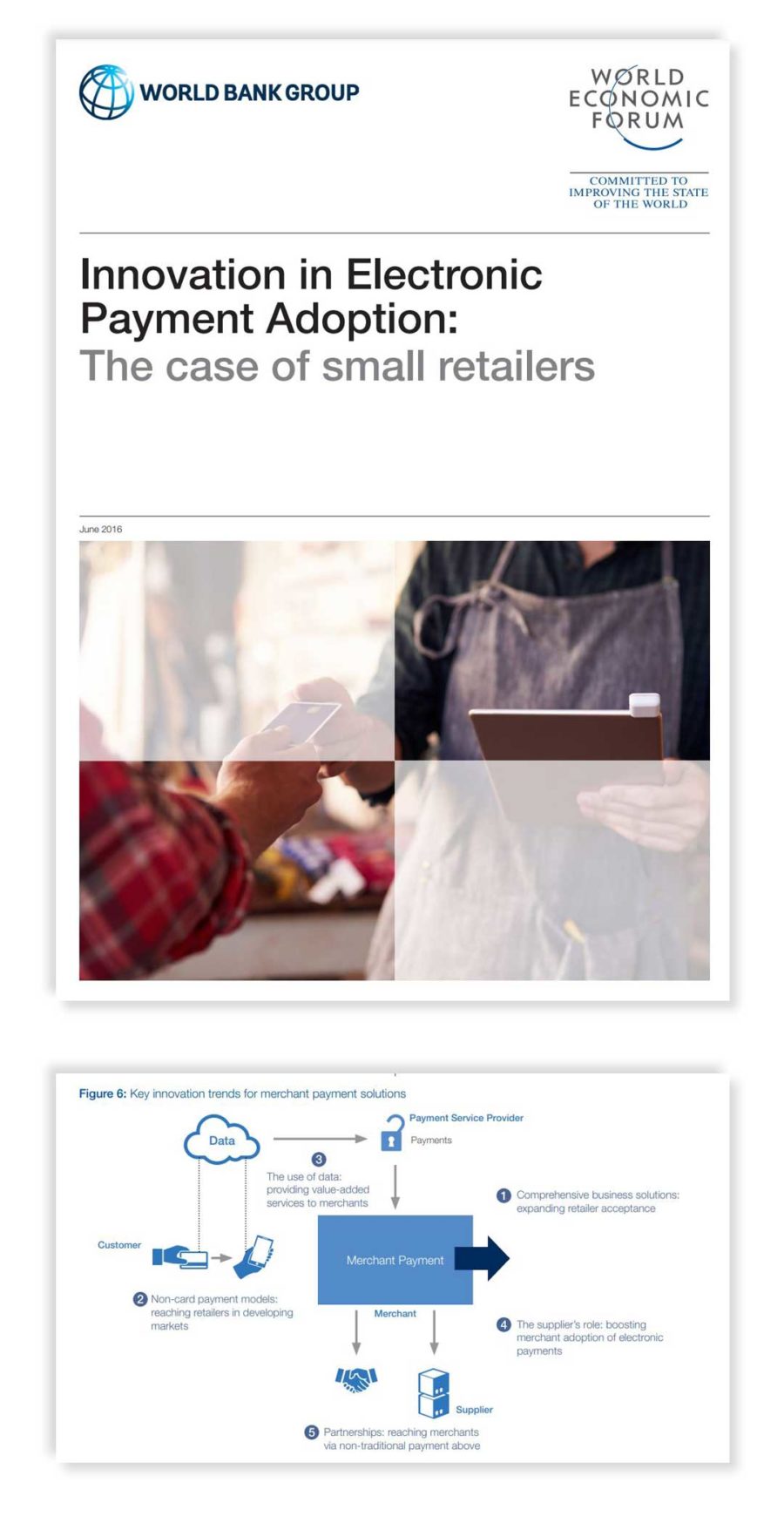

Next, we outlined six primary obstacles that we believed were holding back progress in bringing electronic payments to small retailers. We offered five interconnected innovation trends in the nascent space: comprehensive business solutions, non-card models, value-added services using data, supplier payments, and key partnerships. Each of these trends were complemented with a short case study from both developed and developing markets. Lastly, we concluded with a prioritized list of concrete actions that industry and governments can consider to enhance progress.

The report has since been downloaded over 15,000 times and remains a landmark reference document for electronic payments for small retailers in emerging markets.

[We] hired Digital Disruptions to conduct research and write a landscape report on bringing electronic payments for small merchants. The stakeholder engagement, research and development of insights were conducted in a very tight turnaround, with timetable efficiency, reliability, dedication, a pro-active drive of the project, subject matter expertise, analytical clarity and excitement about the contribution which we were making to the industry knowledge base. The report findings and insights were well-presented and received by the industry.

Nina Bilandzic

Nina Bilandzic

Financial Sector Specialist, Finance, Competitiveness & Innovation

World Bank

Next Case Study

Revamping digital money transfer services to serve migrants in Europe

Ecobank Ghana The Netherlands and Ghana

Using our flagship end-to-end Holistic Innovation Stack™ Methodology to help Ghana’s largest bank craft a comprehensive service to its users in both Europe and Africa.